What is Magnetic Ink Character Recognition ?

Magnetic ink is very useful because it is readable both by humans and by specialized equipment. It is one of the components that makes it possible to process personal checks securely, quickly and accurately.

Magnetic Ink

Magnetic Ink

Magnetic Ink Character Recognition, or MICR, is a character recognition technology used primarily by the banking industry to facilitate the processing of cheques and makes up the routing number and account number at the bottom of a check. The technology allows computers to read information (such as account numbers) off printed documents. Unlike barcodes or similar technologies, however, MICR codes can be easily read by humans.

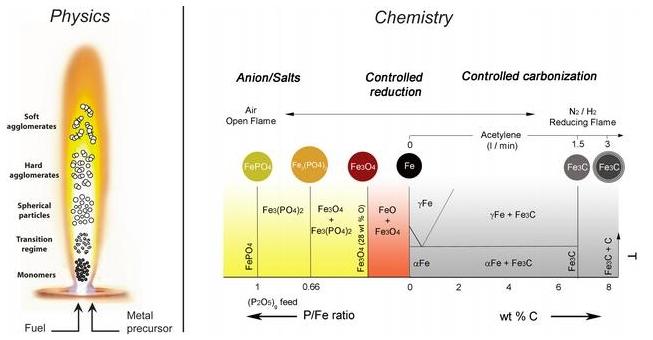

MICR characters are printed in special typefaces with a magnetic ink or toner, usually containing iron oxide. As a machine decodes the MICR text, it first magnetizes the characters in the plane of the paper. Then the characters are passed over a MICR read head, a device similar to the playback head of a tape recorder. As each character passes over the head it produces a unique waveform that can be easily identified by the system.

MICR : Magnetic Ink Character Recognition

Magnetic ink contains particles, usually iron oxide, which are magnetized and read with special equipment compatible with Magnetic Ink Character Recognition (MICR) technology. Because there is a unique signature associated with each magnetized character, MICR equipment identifies each character very quickly and with a very high degree of accuracy, even if the characters are visually obscured by other marks or have been altered with ordinary ink.

Magnetic Ink Art

The acronym MICR stands for Magnetic Ink Character Recognition. This technology uses magnetically chargeable ink or toner to print the numbers and special characters on the bottom of checks or other financial transaction documents.

The numbers usually include the account number from which the money will be drawn,the identification number and the routing and transit of the check for the bank where the account resides. MICR technology is used in the banking industry in many countries because it allows for fast and reliable document processing.

Magnetic Ink Character Recognition, or MICR, is a character recognition technology used primarily by the banking industry to facilitate the processing of cheques and makes up the routing number and account number at the bottom of a check. The technology allows computers to read information (such as account numbers) off printed documents. Unlike barcodes or similar technologies, however, MICR codes can be easily read by humans.

MICR characters are printed in special typefaces with a magnetic ink or toner, usually containing iron oxide. As a machine decodes the MICR text, it first magnetizes the characters in the plane of the paper. Then the characters are passed over a MICR read head, a device similar to the playback head of a tape recorder. As each character passes over the head it produces a unique waveform that can be easily identified by the system.

The use of magnetic printing allows the characters to be read reliably even if they have been overprinted or obscured by other marks, such as cancellation stamps and signature. The error rate for the magnetic scanning of a typical check is smaller than with optical character recognition systems. For well printed MICR documents, the “can’t read” rate is usually less than 1% while the substitution rate (misread rate) is in the order of 1 per 100,000 characters.

In the 1950s, the demand for data processing created a need for a mechanized method of check processing. United States banks, bankers, machine manufacturers, and check processors formed committees to create a solution. The ultimate result of these committees was the adoption of the E-13B Magnetic Ink Character Recognition (MICR) in 1958 by the American Bankers Association (ABA).

The E-13B system uses specially shaped characters, which are printed on the bottom of bank documents. Much of the E-13B information was accepted by the American National Standards Institute (ANSI) and incorporated into several specifications for MICR printing.

Today these specifications are made available by ANSI, which defines, in detail, the formation of the E-13B characters, MICR line placements and components of the line, as well as other components of a bank check. For more information, please refer to the ANSI web site. Some countries have adopted the CMC-7 font providing MICR readability to their banking systems.

You might also like

| Magnetic Nanoparticle What is Magnetic Nanoparticle ? When a piece... | Smart Material : Ferrofluid What is Ferrofluid ? A ferrofluid (portmanteau... | Induction Heating What is Induction Heating ? Induction heating... | Monel Do you know Monel ? Monel is a trademark... |

Alloy Suppliers

Alloy Suppliers

Aluminum

Aluminum

Aluminum Extrusions

Aluminum Extrusions

Copper-Brass-Bronze

Copper-Brass-Bronze

Nickel

Nickel

Magnets

Magnets

Stainless Steel

Stainless Steel

Stainless Steel Tubing

Stainless Steel Tubing

Steel Service Centers

Steel Service Centers

Titanium

Titanium

Tungsten

Tungsten

Wire Rope

Wire Rope